Bernard Otto Holtermann with the world's largest "nugget" of gold, North Sydney, 1874-1876, albumen print from composite photographic negative, Charles Bayliss & Beaufoy Merlin (attributed), State Library of New South Wales - (Merlin, 1874)

HOW MUCH GOLD IS THERE?

This is a figure difficult to ascertain with absolute certainty.

Limiting factors include, the rudimentary technologies and mining techniques of ancient civilisations being one of the factors, Gold reserves aren’t exactly something that governments necessarily disclose to other nations freely either, which makes it difficult to put an exact number of the amount of gold mined throughout human history.

However, a figure that is widely used by investors comes from Thomson Reuters GFMS, which produces an annual gold survey, estimating that number to be in the vicinity of 171,300 tonnes.

According to estimates from the US Geological Survey there are 52,000 tonnes of minable gold still in the ground and more is likely to be discovered.

According to gold historian Timothy Green, gold has been mined for more than 6,000 years. The earliest archeological evidence of gold coins being minted occurred around 550 BC under King Croesus of Lydia - a province in modern-day Turkey – rapidly adopted by the local merchants and mercenary soldiers throughout the Mediterranean as an accepted means of currency.

(Prior, 2013)

Gold coin of Croesus, Lydian, around 550 BC, found in what is now modern Turkey

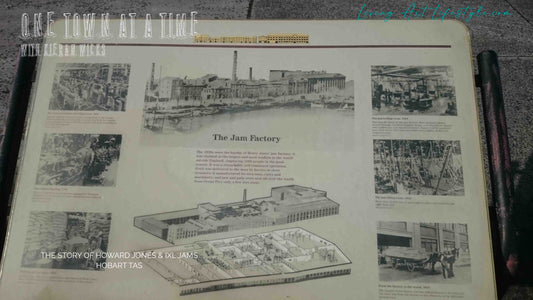

THE MONOLITH - SANDLEWOOD WATCH

Early illustration of Hyde Park and Barracks Sydney, 1842. City of Sydney Archives

View of the northern end of Hyde Park showing Hyde Park Barracks and Mint Building in background with horse racing track. Showing men, women and children.

CURRENCY – THE SYDNEY MINT

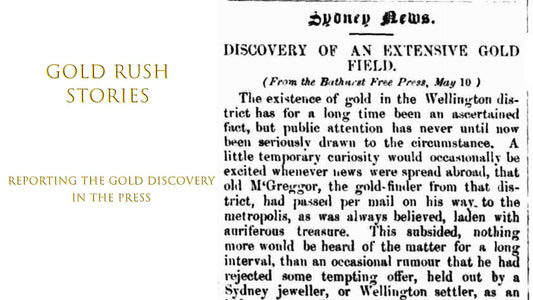

To stem the flow brought on by gold fever the colony administrators kept the discovery of gold secret until it was apparent that it was in the colony’s best interests to create their own mint, the first royal mint outside of England, and establish a local currency and economy.

The Sydney Mint commenced operations in May 1855, some 969 years after London’s Royal mint was founded.

Goldminers transported their raw gold to the Sydney Mint in mammoth quantities, with near 6000 kilograms, valued at £453,000 ($70-90 million today), arriving within the first seven months of the mints opening. Each “Sydney Sovereign” consisted of 8 grams of refined gold.

(What happened if a goldminer found gold?, n.d.)

Sydney Mint (1855). One sovereign cold coin made by the Sydney Mint.

Sydney branch, Royal Mint Macquarie Street attributed to Charles Pickering - 1870

THE GOLD STANDARD

In the simplest terms, the gold standard is a monetary system that ties a currency’s value directly with gold. Therefore, the currency can be exchanged for a set amount of gold and is guaranteed by the government.

(Gold Standard - A Currency's Value In Gold, n.d.)

In such a monetary system, gold backs the value of paper money.

Often romanticised by those opposed to the modern-day fiat economy, an ‘authentic’ international gold standard only existed for nigh on 44 years - from 1871 to 1914 – following the peaks of the gold rush in an unprecedented time of world peace. However, many a modern-day economist views ‘The gold standard’ as a symptom, rather than the cause of this peace and prosperity.

The first nation to officially adopt a gold standard was England in 1821.

The gold standard came to prominence aided by the dramatic rise in global trade and production, in hand with the large swathes of gold discovered throughout the century, enforcing the gold standards grip on the international economy well into the next century.

Nations settled trade imbalances with gold, giving world governments strong incentive to stockpile their gold reserves for a rainy day. These stockpiles still exist today.

The central banks of America, England and France hoarded vast quantities of the gold flowing from the Californian and Victorian fields, which in turn provided the basis for sound currencies and solid financial systems across the known world, supporting an immense credit expansion that bankrolled world trade, shipping and manufacturing.

Following Germany’s adoption of the standard in 1871, the international gold standard emerged, with the majority of the world’s developed nations participating in trade it by 1900.

From 1871 to 1914, the gold standard was at its pinnacle, but with the outbreak of the Great War in 1914, this all changed forever.

As the gold supply continued to fall behind the growth of the global economy, the British pound sterling and U.S. dollar became the global reserve currencies. Smaller countries began holding more of these currencies instead of gold. The result was an accentuated consolidation of gold into the hands of a few large nations.

(LIOUDIS, 2021)

Microfleece Hoodie Tree of Life Collection

For more background and FAQ’s on the History of the Gold Standard check out Mark Harrison’s article Did the Gold Standard Work? Economics Before and After Fiat Money

Which address questions such as:

- How is a classical gold standard supposed to work?

- How did it actually work out in the past?

- Why did previous versions of the international reserve currency lose their mantle?

- What is the record of the fiat currency version of the dollar as an international reserve currency?

- And why is it now rather than some other moment that gold is so much discussed?

https://blogs.cfainstitute.org/investor/2013/04/16/gold-and-international-reserve-currencies/

(Mark Harrison, Did the Gold Standard Work? Economics Before and After Fiat Money, 2013)

Tree of Life Collection Inner Desire Collection Flame Trees Collection

BRETTON WOODS AGREEMENT

- The Bretton Woods Agreement and System created a collective international currency exchange regime that lasted from the mid-1940s to the early 1970s.

- The Bretton Woods System required a currency peg to the U.S. dollar which was in turn pegged to the price of gold.

- The Bretton Woods System collapsed in the 1970s but created a lasting influence on international currency exchange and trade through its development of the IMF and World Bank.

(Anderson, n.d.)

WORLD CONFERENCE ON MONETARY PLANS

WASHINGTON, Sunday - President Roosevelt has called an international monetary conference, which will begin on July 1, to discuss postwar financial problems. Invitations have been sent to 43 nations, including Australia. New Zealand and the French Committee of Nations' Liberation.

Tho conference will be held at Bretton Woods, New Hampshire. A White House announcement said it was expected to last several weeks. All agreements worked out would subsequently be submitted to the Governments for approval. The U.S. delegation would be headed by the Secretary of thc Treasury (Mr. Morgenthan).

The Associated Press says the conference will consider proposals for a 10,000,000.000 dollar world bank for reconstruction and development.

WORLD CONFERENCE ON MONETARY PLANS (1944, May 29). Advocate (Burnie, Tas. : 1890 - 1954), p. 2. Retrieved July 21, 2021, from http://nla.gov.au/nla.news-article68852336

Washington Hotel in Bretton Wood, New Hampshire (Wikicommons)

EXPERTS MEET IN AMERICA

World Monetary Conference

Australian Associated Press

NEW YORK, July 1.

The United Nations monetary conference opened at Bretton Woods, New Hampshire, today. Proposals are to be examined for an international bank and post war monetary stabilisation, but all agreements readied must tie referred to the Governments concerned for adoption or rejection. The British delegation is headed by Lord Keynes and the American by the Secretary to the Treasury Mr. Morgenthau and Dr. Harry White. The Acting Director of the International Labor Office (Mr. [Edward J. Plielan) is attending as official observer. The Associated Press of America; says that President Roosevelt, in a message to the conference, said "Commerce is the lifeblood of free society; we must see that its arteries are not clogged again by artificial barriers created through senseless economic rivalries Economic diseases are highly communicable. It follows therefore that the economic health of every country is a proper matter of concern to all its neighbours. Only through a dynamic and soundly expanding world economy can the living standards of individual nations be advanced to levels permitting the full realisation of our hopes or the future."

Mr. Morgenthau. accepting the presidency of the conference, said "Economic aggressions can have no other offspring than war. The nations must approach the task of establishing a sound stable economic relationship as partners, not bargainers." Mr. Morgenthau said that he hoped the conference would keep before it two elementary axioms - that prosperity has no fixed limits and the more other nations enjoy the more each nation will have for itself: and that prosperity, like peace, is indivisible.

EXPERTS MEET IN AMERICA (1944, July 3). The Advertiser (Adelaide, SA : 1931 - 1954), p. 2. Retrieved July 21, 2021, from http://nla.gov.au/nla.news-article43210718

AURAS COLLECTION GREYSTAR COLLECTION

United States May Lose Gold Hoard After War

BRETTON WOODS (US), 'Wednesday.- — The United States may lose a substantial portion of its 2 0,000,000,000 dollars (£6,250,000,000) gold hoard after the war, as the result of world- reconstruction plans. This is the view of Dr. Harry White, president of the International Monetary Conference. The United States alone among the nations could stand drain on her gold supply, he said. He pointed out that some of the gold came to America In the flight of capital from various nations, many of which were torn by war.

When the world was restored to peace, this gold would be taken home, Dr. White added. He expressed his belief that gold had given the United States big bargaining power in world markets.

Dr. White said today that the conference might have to adjourn on July 20 without reaching an agreement. In that case, he said, there would probably be another conference.

Dr. white, also said that a difference arose concerning the amount of currency to be purchased annually from the fund. The proposal was to limit it to 25 per cent, of the contribution, but some countries, including Australia, wished to increase it to 33 per cent. Dr. White, added that the principal controversial issues included apportionment of subscription quotas among individual countries for the postwar fund; use of gold for the fund; what action should be taken If any country requests currency from the fund in order to expand its production and employment "contrary to the proposed purposes of the fund"; and whether, and how, the fund should deal with large blocked balances, chiefly British, built up during the war. — "Sun" Special and AAP.

United States May Lose Gold Hoard After War (1944, July 6). The Sun (Sydney, NSW : 1910 - 1954), p. 5 (LATE FINAL EXTRA). Retrieved July 21, 2021, from http://nla.gov.au/nla.news-article231694542

“The Ringer Collection - Goddess Robe

"World Money Plan - Or Chaos"

NEW YORK, "Friday AAP).-The British representative; to the United Nations monetary conference, Lord Keynes, ' told a press conference that although the proposals for an international fund were admittedly controversial, all possible alternatives were so much worse that the world must accept the plan in order to avoid monetary and economic chaos, says the New York. "Times" correspondent at Bretton Woods.

The correspondent reports that an additional issue on the impending agreement arose when the Russian delegation made their demands for a larger quota for the proposed international fund commensurate with Russia's expected position after the war.

"The Soviet delegation expressed willingness to accept 1 third place, but wants its quota increased to approximately Britain's."

"World Money Plan—Or Chaos" (1944, July 8). Northern Star (Lismore, NSW : 1876 - 1954), p. 1. Retrieved July 21, 2021, from http://nla.gov.au/nla.news-article98988659

The gold Standard was replaced by an economic theory known as the Fiat Money system

WHAT IS FIAT MONEY?

Fiat money is government-issued currency that is not backed by a physical commodity, such as gold or silver, but rather by the government that issued it. The value of fiat money is derived from the relationship between supply and demand and the stability of the issuing government, rather than the worth of a commodity backing it as is the case for commodity money.

Most modern paper currencies are fiat currencies, including the U.S. dollar, the euro, and other major global currencies.

(CHEN, 2021)

THE RINGER II - AREA RUG 5' ROUND

BLACK GOLD – THE EMERGENCE OF THE PETRODOLLAR

After the collapse of the Bretton Woods gold standard in the early 1970s, the United States struck a deal with Saudi Arabia to standardize oil prices in dollar terms. Through this deal, the petrodollar system was born, along with a shift away from pegged exchanged rates and gold-backed currencies to non-backed, floating rate regimes.

(TUN, 2021)

The petrodollar system is tied to the history of the gold standard. After World War II, the United States held most of the world's supply of gold. It agreed to redeem any U.S. dollar for its value in gold if the other countries pegged their currencies to the dollar. Other countries signed onto this deal in the 1944 Bretton Woods conference. It established the U.S. dollar as the world's reserve currency.

On February 14, 1945, President Franklin D. Roosevelt initiated the alliance with Saudi Arabia.1 He met with Saudi King Abd al-Aziz. The United States built an airfield at Dhahran in return for military and business training. This alliance was so critical that it survived subsequent years of differences of opinion over the Arab-Israeli conflict.

The shift from oil to other renewable energy sources could threaten the petrodollar.

(AMADEO, 2020)

For those of you wishing to dive deeper, I recommend Robert Newman’s History of Oil, for a comedic and entertaining exploration into the historical events surrounding the ascendance of the Petrodollar.

(Newman, n.d.)

E.E.C. TALKS ON OIL FUNDS, GOLD

LONDON, Tuesday (AAP-Reuter). — Common Market finance ministers meet in London today to prepare a joint approach on how to get surplus funds accumulated by Arab and other oil producing states back into the world economy.

The two-day meeting will also examine the future of gold in the international monetary system.

Authoritative sources said the nine EEC countries were virtually agreed that there should be a petrodollar recycling mechanism centred on the international monetary fund which' would not require sums to be guaranteed by individual states.

But a main issue at the talks is the reservation of West Germany and some other countries about the proposal of US Secretary of State, Dr Kissineer, for the creation of a separate recycling facility for co-operation among ' consuming countries in trouble with big oil payments deficit.

E.E.C. TALKS ON OIL FUNDS, GOLD (1975, January 8). The Canberra Times (ACT : 1926 - 1995), p. 19. Retrieved July 21, 2021, from http://nla.gov.au/nla.news-article110631962

INNER DESIRE V COLLECTION - WRAP SKIRT

GOLD, OIL AND DOLLARS

APPROPRIATELY enough for the "silly season", gold has figured, more than usually prominently in the news in the past few weeks. Attention has been concentrated on Americans' reaction to the lifting of the 41-year-old prohibition on private gold hoarding, a move' forced on the Administration by Congress, which last year tied an amendment to a Bill providing • a large American contribution to the International Development Association, the "soft-loan" agency of the World Bank. As might have been expected in the light of erratic, speculative movements in gold prices during 1974 and the US Treasury's decision to put two million ounces of its 276 million ounces on the market, the great American, gold rush did not eventuate when gold trading opened last week and prices eased away from the magical 5US200 (SA154) barrier around which they had been hovering in December.

At the beginning of 1974 the free market price of gold was around SUS120 an ounce. It climbed steeply in the first three months of the year to a peak around SUS180 early in April and declined steadily to about SUS130 in July. Since then it has made a steady if halting recovery to around SUS190 with a late December peak of 5US198, nearly five times the official price of SUS42. Several factors, including the uncertain behaviour of commodity prices, deliberate manipulation of expectations about the gold supply and manipulation of the supply itself by the US Treasury, have been responsible for the behaviour of the gold price, but the underlying factor remains uncertainty about the international monetary system as a result of inflation and impinging international recession. In spite of erratic and potentially very costly fluctuations in its price, gold will continue in the popular mind as a most attractive inflationary hedge while distrust in paper currencies persists.

The long-term question that may be answered in 1975 is whether or not gold will reassert itself as a pre-eminent component in the international monetary system, shedding the de-facto role foisted on it first by the artificial two-tier system, which pegged its official price while letting market prices fluctuate, and then by the Americans' decision to abandon dollar-gold convertibility in 1971. This was an increasingly onerous arrangement because of the huge amount of unwanted dollars in Europe, the result of accumulated American post-war balance-of-payments deficits which were running at an alarming annual rate during the peak of the Vietnam War in the late 1960s. The Americans' perfectly rational economic argument for the demonetisation of gold, that the world's money supply should not be determined by supplies of some metal (new supplies of which are largely controlled by the Soviet Union and South Africa), has become inextricably linked with political arguments about the main - alternative, the American dollar. Europe, and France in particular, is severely distrustful of the ability of the American Administration and Congress to manage its economy and its currency in an internationally responsible fashion, and of "dollar imperialism".

Windfall for Some

The recent, rather arrogant agreement between America's President Ford and France's President Giscard d'Estaing in Martinique, that official government gold holdings may be calculated in future at current prices, seemed an important step towards the restoration of gold to a pre-eminent position. Such a decision, if proceeded with, would ignore than quadruple at current prices official gold holdings. But there are objections - to the move which will bear on its implementation. In the first place, such an automatic revaluation would provide windfall gains for the largest gold holders who, apart from the Soviet Union, are the affluent western nations, without any regard for the needs of members of the Third World. It is argued that such a massive ' increase in international reserves should be distributed & more equally, or according to need. Second, revaluation of gold by such a large-multiple would lessen even further the importance of Special Drawing Rights, with which the international community had hoped to replace both gold and dollars as the major international currency. Third, and of most short-term importance, such a move would tend to be highly inflationary, as pointed out by the Shah of Iran when he threatened that the US-French agreement could be used to justify abandonment of the nine-month freeze on oil prices declared by OPEC last month.

This week the EEC finance ministers meeting informally in London accepted a proposal for recycling, "petrodollars" through an International Monetary Fund facility, effectively rejecting, an alternative American proposal, for a recycling facility under the auspices of the OECD, membership of which is confined to the industrialised western nations. The agreement could be ratified at a meeting of the IMF in Washington next week. Whether the situation can be resolved remains as uncertain as the prospects for the international monetary system itself, and in those circumstances, rational or not, gold will continue to be used as a popular inflationary hedge with the likelihood of further substantial increases in its price.

GOLD OIL AND DOLLARS - The Canberra Times (1975, January 10). The Canberra Times (ACT : 1926 - 1995), p. 2. Retrieved July 21, 2021, from http://nla.gov.au/nla.news-article110632276

BUY YOURS TODAY AND FEEL LIKE A SUPERHERO IN OUR GREYSTAR CLOAK AS YOU TAKE ON THE ELEMENTS!

DECLINE OF THE WEST

"It is becoming all too clear that the power of the oil cartel threatens the future of Western civilisation." wrote Fortune, leading U.S. business magazine, in a December 1974 editorial. First, there is the short-term problem: the petrol billions are piling up in the form of short-term deposits in British (and American) banks. These banks cannot make long-term loans on these short-term deposits to those countries which are now faced with massive trade deficits. The danger is that the latter "may have to cheapen their currencies, or restrict imports or both" to lessen trade deficits. As a result, "world trade will shrink" and a global depression result the long-term problem says Fortune, is that the high price of oil leads to an unprecedented and unacceptable transfer of wealth". In 1975, the Organisation of Petrol Exporting Countries (OPEC) will have more capital reserves than all the gold and currency of the rest of the capitalist world combined. The sustained, but comparatively gradual growth in the power of West Europe and Japan in relation to the United States in the late '50s and throughout the '60s led to crises in the'70s until the United States was forced to recognise its new power relationship with Europe. Some theoreticians at the time speculated, somewhat mechanically, on the danger of war between the U.S. and Europe, based on the very real clash of economic interests. The virtual overnight rise of the OPEC nations into a major centre of finance capital, impoverishing European capitalist powers and threatening the U.S., makes the danger of a war between them and the U.S. even more likely. The threat of Kissinger and Ford to "send in the marines" is therefore no idle boast. Imperialism finds such sudden shifts in power very difficult to absorb. The conservatives of OPEC - Iran and Saudi Arabia - are the ones with the aces, as they are the major oil producers. They recently vetoed a plan by OPEC radicals for a new attack on U.S and Europe, to finance cartels of other producers of raw I materials, cut back production of oil to meet only the OPEC nations current expenditure, and withdraw oil billions from western banks. Iran and Saudi Arabia instead proposed to freeze oil prices and recycle the petrodollars to Europe and the U.S., in return for a form of "indexation" of oil prices to other commodity prices. The real question remains, even within the conservatives' plan, whether U.S. and European imperialism will accept the "unacceptable" transfer of wealth that is taking place. If they do not, the world could be thrown into a worldwide conflict.

DECLINE OF THE WEST (1975, February 11). Tribune (Sydney, NSW : 1939 - 1991), p. 3. Retrieved July 21, 2021, from http://nla.gov.au/nla.news-article236919722

REFERENCES

-

AMADEO, K. (2020, November 22). Petrodollars and the System that Created It. Retrieved from the balance: https://www.thebalance.com/what-is-a-petrodollar-3306358

- Anderson, S. (n.d.). Bretton Woods Agreement and System. Retrieved from Investopedia: https://www.investopedia.com/terms/b/brettonwoodsagreement.asp

- CHEN, J. (2021, April 16). What Is Fiat Money? Retrieved from Investopedia: https://www.investopedia.com/terms/f/fiatmoney.asp

- DECLINE OF THE WEST (1975, February 11). Tribune (Sydney, NSW : 1939 - 1991), p. 3. Retrieved July 21, 2021, from http://nla.gov.au/nla.news-article236919722

- E.E.C. TALKS ON OIL FUNDS, GOLD (1975, January 8). The Canberra Times (ACT : 1926 - 1995), p. 19. Retrieved July 21, 2021, from http://nla.gov.au/nla.news-article110631962

- EXPERTS MEET IN AMERICA (1944, July 3). The Advertiser (Adelaide, SA : 1931 - 1954), p. 2. Retrieved July 21, 2021, from http://nla.gov.au/nla.news-article43210718

- Gold Standard - A Currency's Value In Gold. (n.d.). Retrieved from Corporate Finance Institute: https://corporatefinanceinstitute.com/resources/knowledge/economics/gold-standard/

- LIOUDIS, N. (2021, April 27). What is the Gold Standard? Retrieved from Investopedia: https://www.investopedia.com/ask/answers/09/gold-standard.asp

- Mark Harrison, C. (2013, April 16). Did the Gold Standard Work? Economics Before and After Fiat Money. Retrieved from CFA Institute: https://blogs.cfainstitute.org/investor/2013/04/16/gold-and-international-reserve-currencies/

- Newman, R. (n.d.). Robert Newman's History of Oil. Retrieved from Youtube: https://www.youtube.com/watch?v=sehmmzbi3UI

- Prior, E. (2013). How much gold is there in the world? Retrieved from BBC.Com: https://www.bbc.com/news/magazine-21969100

- TUN, Z. T. (2021, April 21). How Petrodollars Affect the U.S. Dollar. Retrieved from Investopedia: https://www.investopedia.com/articles/forex/072915/how-petrodollars-affect-us-dollar.asp

- United States May Lose Gold Hoard After War (1944, July 6). The Sun (Sydney, NSW : 1910 - 1954), p. 5 (LATE FINAL EXTRA). Retrieved July 21, 2021, from http://nla.gov.au/nla.news-article231694542

- What happened if a goldminer found gold? (n.d.). Retrieved from https://sydneylivingmuseums.com.au/stories/what-happened-if-goldminer-found-gold

- WORLD CONFERENCE ON MONETARY PLANS (1944, May 29). Advocate (Burnie, Tas. : 1890 - 1954), p. 2. Retrieved July 21, 2021, from http://nla.gov.au/nla.news-article68852336

- "World Money Plan—Or Chaos" (1944, July 8). Northern Star (Lismore, NSW : 1876 - 1954), p. 1. Retrieved July 21, 2021, from http://nla.gov.au/nla.news-article98988659

IMAGE REFERENCES

- Bernard Otto Holtermann with the world's largest "nugget" of gold, North Sydney, 1874-1876, albumen print from composite photographic negative, Charles Bayliss & Beaufoy Merlin (attributed), State Library of New South Wales - (Merlin, 1874)

- Gold coin of Croesus, Lydian, around 550 BC, found in what is now modern Turkey - Classical Numismatic Group, Inc. http://www.cngcoins.com, CC BY-SA 3.0 <http://creativecommons.org/licenses/by-sa/3.0/>, via Wikimedia Commons https://commons.wikimedia.org/wiki/File:Kroisos._Circa_564-53-550-39_BC._AV_Stater_(16mm,_10.76_g)._Heavy_series._Sardes_mint.jpg

- (1842). Early illustration of Hyde Park and Barracks Sydney, 1842. City of Sydney Archives

- Sydney Mint (1855). One sovereign cold coin made by the Sydney Mint. https://collection.maas.museum/object/293596

- Sydney branch, Royal Mint Macquarie Street attributed to Charles Pickering – 1870 - Pickering, Charles Percy. Sydney Branch, Royal Mint [Macquarie Street / Attributed to Charles Pickering], 1870. https://search.sl.nsw.gov.au/permalink/f/1cvjue2/ADLIB110316260

- Washington Hotel in Bretton Wood, New Hampshire - Miscellaneous Items in High Demand, PPOC, Library of Congress, Public domain, via Wikimedia Commons - https://commons.wikimedia.org/wiki/File:Mt._Washington_hotel_in_Bretton_Wood,_New_Hampshire_-1_LCCN2013646541.jpg

LUMINOUS COLLECTION

GOLDEN EYE COLLECTION YOGA LEGGINGS

Subscribe to our newsletter now to keep updated on our adventures!

Do you want to spoil that special someone?

Do you need a unique gift idea for birthdays or Christmas?

Presents for him or Presents for her?

Our Gift Idea Collections will solve all of your problems.

Gifts for Him and Gifts for Her, Living Art Lifestyle is the ideal gift idea resource.

There’s so much to choose from you’re assured to find the perfect present for her and a guaranteed great gift for him!

Rest assured, you’re not alone, the perfect gift can be hard to find, and that’s what we are here for, devoted to providing you with the ideal gift experience.

An interior decorator’s delight, enhance and bring warmth to any room with our unique home décor solutions.

Winter fashion and summer fashion are taken care of with our exclusive ranges of inspired, versatile all seasons designer fashion.

Along with our selection of exquisite jewelry, whether it be a pendant necklace, ring or bracelet our artisan designed, Bohemian Chic collections are assured to complete any ensemble.

A magic carpet ride, our artisan designs transport you to another world.

Learn the stories behind the designs HERE on our blog.

Bring the adventure home and decorate your everyday with real-life fairy-tale scenes, illuminating the essence of Mother Nature’s esoteric magic and wonder…

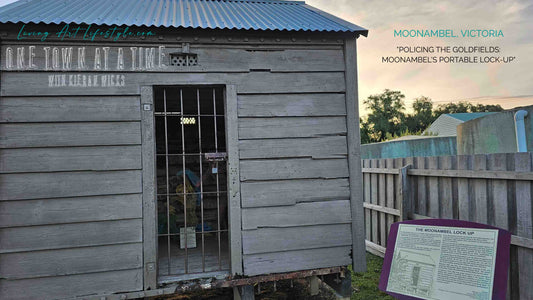

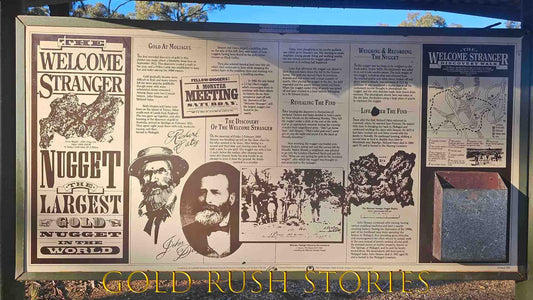

If you’re looking for unique travel ideas, things to do or places to visit, Living Art Lifestyle is the ultimate trip planner essential for your next holiday vacation as you discover Australia, One Town at a Time. Tourist attractions, and secret destinations sure to make your next road trip one to remember.

Explore Australia and learn the stories behind our designs, One Town at a Time, our part travel vlog, part tour diary, part history lesson, part wildlife documentary, with moments of delight, debauchery, self-discovery and determination.